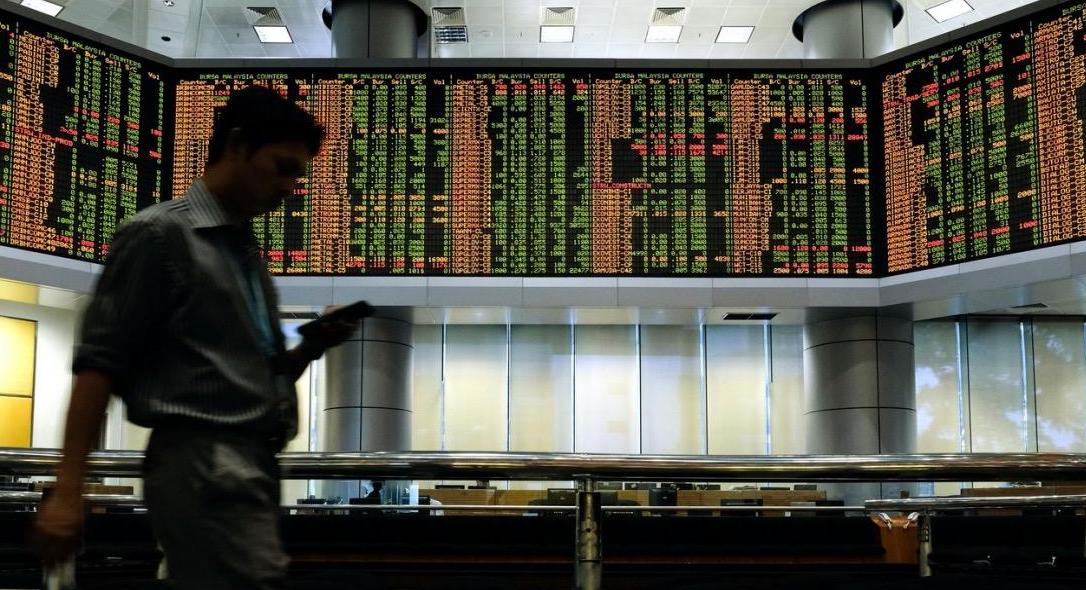

KUALA LUMPUR, July 1 — AmInvestment Bank Bhd is mildly positive on the local stock market in the second half of 2020 (2H 2020), with the benchmark FTSE Bursa Malaysia KLCI (FBM KLCI), projected to reach 1,530 points at year-end.

At noon break, the FBM KLCI rose 6.51 points to 1,507.48 from Tuesday’s close of 1,500.97.

AmInvestment Bank’s head of equity research Malaysia Joshua Ng said the FBM KLCI year-end target was based on 18 times the bank’s 2021-forecast earnings projection growth of 19.7 percent, which is in line with its five-year historical average.

“We believe there is a case for the FBM KLCI multiples to stay elevated to reflect the robust domestic liquidity driven by the risk-on sentiment globally,” he said in the bank’s Strategy 2H 2020 Market Outlook report today.

Ng explained that the risk-on sentiment globally was triggered by the massive monetary and fiscal stimulus packages put in place by central banks and governments around the globe, optimism on economies reopening, and the news flow on vaccine development.

“Also helping is the reality that risk-free assets, such as cash and Malaysian Government Securities (MGS), are hardly generating any positive inflation-adjusted yield,” he said.

He noted that the next driver could come from the return of appetite for risk assets, including emerging market (EM) or EM equities, on expectations that the COVID-19 pandemic will gradually come under control, or simply driven by the need for investors to look elsewhere for opportunities.

This is because the valuations of developed market equities, especially the large-cap tech stocks, have become increasingly rich, he said.

Meanwhile, Ng said the bank is “overweight” on the automobile, consumer, glove, healthcare, power, real estate investment trust (REIT), and technology sectors.

He said the bank believes there is a case for staying fully invested in the glove sector, as no one knows for sure if the pandemic is going to go away or evolve into another wave, or if any effective treatment drug or vaccine could be found anytime soon.

On the technology sector, he said tremendous investment in both software and hardware technology was spurred by new norms such as working from home, virtual meetings, distance learning, online grocery shopping, and food delivery.

“On the one hand, the pandemic has disrupted the rollout of 5G in certain countries, but on the other hand, it has actually sped up the adoption of 5G in a few cities in China out of necessity,” he said.

Ng said the bank forecasts a strong 2H 2020 for the automobile sector, driven by a surge in car sales on reduced new car prices thanks to the sales tax holiday from June 15- Dec 31, 2020, under the short-term National Economic Recovery Plan (PENJANA).

“If the economy does recover strongly from the pandemic over the immediate term, there is a better chance that most businesses will survive, and hence the risk of a significant uptick in the loan credit cost of the banks at the end of the six-month loan moratorium will be mitigated,” he said.

Ng said other sectors that would benefit from the recovery in demand or pent-up demand post-pandemic are healthcare, due to an increase in semi-elective and elective procedures, power (an increase in electricity demand from the commercial and industrial segments), seaports (higher throughput on a recovery in global trade), toll roads (traffic to normalize) and tourism (a recovery in domestic or regional tourism).

“Meanwhile, with recovering footfalls to the shopping malls, retail Real Estate Investment Trusts will gradually take back the rental rebates offered to the tenants, paving the way for the normalization of distributable incomes,” he said.

More Stories

RM7.9 Billion For TVET To Enhance Local Skilled Talent Development

Nation Recovers RM15.5 Billion Of Its Revenue, War Against Corruption And Cartels To Go On – Anwar

Budget 2026 Reflects Govt’s Commitment To Integrity, Curbing Leakages – Azam